New California Property Tax Report Required for Some Short-Term Real Estate Rentals Starting 2024

The landscape of property taxation in California is undergoing a shift, and if you're involved in short-term real estate rentals, it's crucial to stay informed about the changes on the horizon. The California State Board of Equalization (BOE) has given the green light to the proposed Form BOE-571-STR, a significant step aimed at enhancing the accuracy of personal property tax assessment for short-term real estate rentals. Effective January 1, 2024, this new requirement mandates property owners to report crucial information to compute personal property tax.

What You Need to Know:

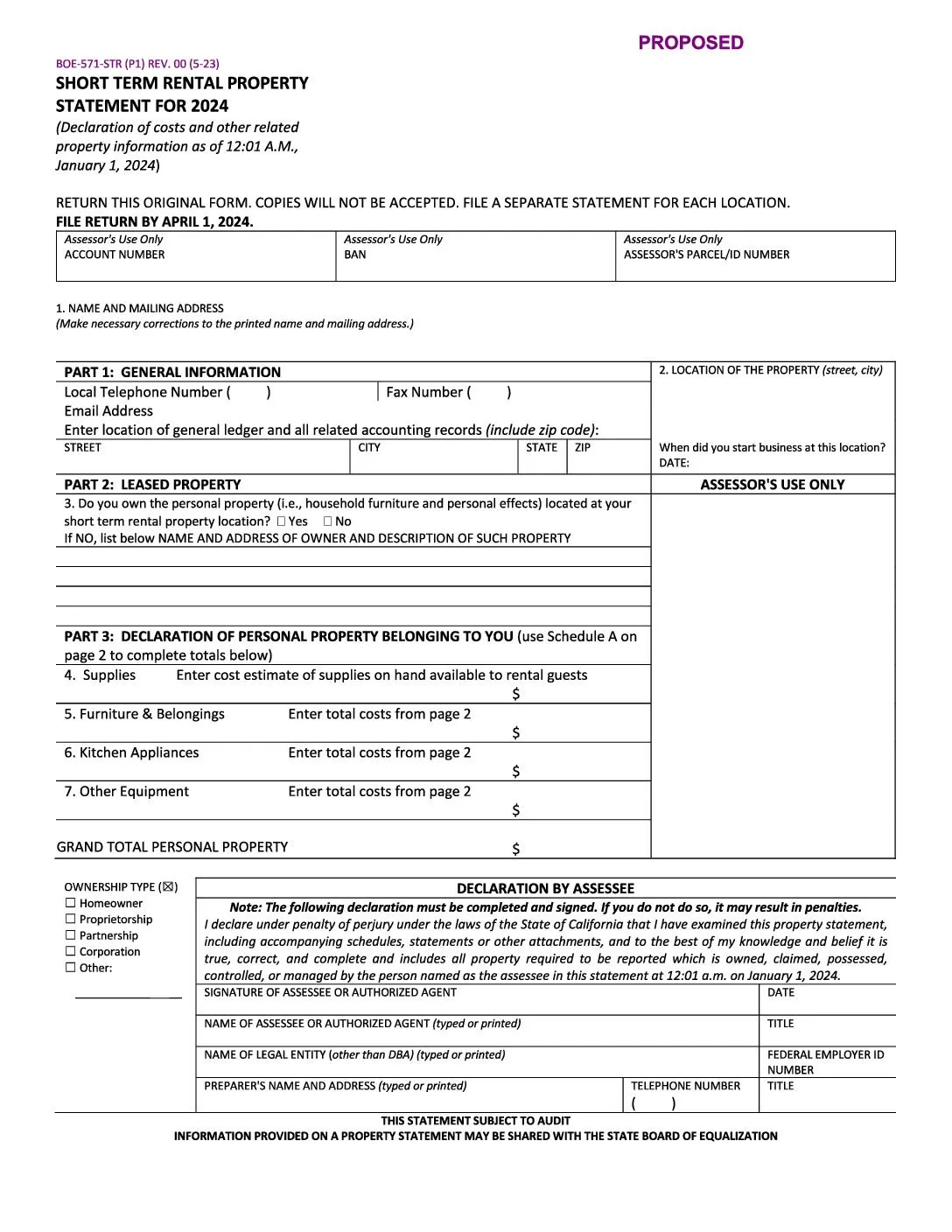

Form BOE-571-STR: Starting January 1, 2024, property owners engaged in short-term real estate rentals, including platforms like Airbnb and VRBO, will be required to file Form BOE-571-STR. This form serves as a means to report information necessary for the computation of personal property tax associated with short-term rental activities.

Filing Deadline: The inaugural Form BOE-571-STR report is due by May 7, 2024. It's essential to mark this date on your calendar and prepare to fulfill this new obligation.

Trade or Business Classification: The BOE considers short-term real estate rentals to be a trade or business, making them subject to personal property tax. This classification is significant as it entails tax implications that property owners need to be aware of.

Business Personal Property Tax Assessment: As a result of this classification, property owners are subject to business personal property tax assessment on various assets used in the rental activity. This includes furnishings, furniture, appliances, equipment, and supplies associated with the short-term rental.

Complete Reporting: When filing Form BOE-571-STR, it's essential to provide comprehensive information about the assets used in the rental activity. The form does not allow for prorated reporting of items in shared rooms, such as living rooms, dining rooms, bathrooms, and kitchens. Instead, the total cost of these items should be reported.

Depreciation Considerations: The county assessor will apply a depreciation factor based on the year the property was acquired. Understanding how depreciation factors into the tax assessment process is vital for accurate reporting.

Preparing for Compliance: Some property owners might find it challenging to gather accurate acquisition year and cost information, especially if the property was acquired for personal use many years ago. As these reporting requirements are soon to be implemented, now is an opportune time to start assembling this crucial information.

Threshold for Reporting: Every business that owns taxable personal property (excluding manufactured homes) with a cumulative cost of $100,000 or more for any assessment year must file a signed property tax statement with the county assessor.

Direct Billing and Reporting Frequency: Businesses falling below the threshold value are only required to file upon the request of the county assessor unless they qualify for direct billing. Businesses that qualify for direct billing might only need to file statements every three or four years, provided the property value remains relatively consistent.

Sources for Information: The BOE will source information to request reports from various channels, including information reports received by the IRS, business license registrations, and transient tax reports.

As the landscape of property taxation evolves, it's crucial to incorporate this new requirement into your year-end planning discussions with your tax advisor. Staying informed and proactive ensures compliance and a smooth transition into the new reporting framework. If you're a property owner engaged in short-term real estate rentals, consider this a vital item on your agenda as you navigate the intricacies of property taxation in California.

Disclaimer: The information provided in this post is based on the knowledge available up to August 1, 2023. Regulations and requirements may change over time, and it's advisable to verify information from official sources and consult with a tax professional for personalized guidance.