Navigating Tax Deductions: Deciphering the Maze of Meals, Entertainment, and Marketing Expenses

In the ever-evolving landscape of tax regulations, it's crucial to discern between deductible expenses and areas that might raise red flags. One such area of complexity is the realm of meals, entertainment, and marketing expenses. Let's unravel the intricacies and explore tips to ensure compliance with the rules.

Understanding the Shift: Meals vs. Entertainment

Gone are the days of bundling client outings with dinner under the broad category of "meals and entertainment." The Tax Cuts and Jobs Act has drawn a clear line, making entertainment expenses entirely non-deductible. While the distinction seems straightforward, real-world scenarios, especially when mingling marketing costs, can pose challenges.

Non-Deductible Entertainment Expenses: What to Watch Out For

The following entertainment expenses are no longer deductible:

- Sporting events, concerts, theater tickets, and recreational activities.

- Meals included in the cost of entertainment outings.

- Recreational trips intended to entertain clients or foster business relationships.

For instance, if an oral surgeon treats a dentist to a baseball game, considering it entertainment, the game tickets' cost becomes non-deductible.

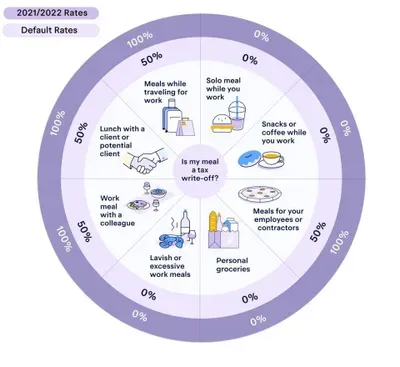

Partially Deductible Business Meals: Navigating the Landscape

While entertainment faces restrictions, business meals retain a 50% deductible status. This includes:

- Business meals with clients.

- Meal expenses during work-related travel.

- Lunches with fewer than half of company employees.

- Meals provided for the employer's convenience, like those in a company cafeteria.

Notably, for 2021 and 2022, businesses can fully deduct business meals, aiming to support the restaurant industry amid the pandemic recovery.

100% Deductible Business Meals: Special Scenarios

Certain business meals still enjoy full deductibility, such as:

- Social activities for employees (holiday parties, company picnics).

- Company events open to the public with provided food and beverages.

IRS Guidance: Proposed Regulations for Deductibility

To navigate the nuanced realm of meals and entertainment deductions, the IRS proposed regulations in February 2020. The regulations present a five-part test for 50% deductible meals, ensuring:

- Expense is an ordinary and necessary business expense.

- The meal is not extravagant under the circumstances.

- The business owner or employee is present.

- Food and beverages are provided to a current or potential business contact.

- In cases of food or beverages during an entertainment activity, costs are separated on bills or receipts.

Diving Deeper: Examples and Scenarios

To bring clarity, consider scenarios like:

- Reno Aces Game: If an oral surgeon buys hot dogs and drinks separately at a game, 50% of these expenses are deductible.

- Luxury Suite Sponsorship: When costs of a suite include game tickets and food, and the sponsor isn't present, deductions are disallowed.

Marketing Expenses: The Deductible Edge

Unlike the stringent rules for meals and entertainment, marketing expenses for business growth and client retention remain fully deductible. This encompasses:

- Advertising via various channels.

- Public relations and promotional expenses.

- Printing materials like business cards and brochures.

Navigating Gray Areas: Examples of Deductible Marketing Expenses

- Custom Labeling Wine: The cost of labeling for promotional gifts is 100% deductible; however, limits apply to the cost of wine.

- "Lunch and Learn" Events: Promotional events where meals are served throughout are fully deductible.

- Sponsoring Golf Outings: Separate invoicing for food allows a 50% deduction for meals, while the golf sponsorship falls under entertainment.

Simplified Bookkeeping: A Strategic Approach

Given the intricacies, ditch the generic "Meals & Entertainment Expense" category. Instead, create distinct classifications for 100% deductible meals, 50% deductible meals, non-deductible entertainment, and fully deductible marketing expenses. This not only ensures compliance but also streamlines bookkeeping.

In the dynamic landscape of tax regulations, staying informed and strategic categorization are your allies. For personalized advice, consult a tax professional, ensuring your deductions align with the ever-evolving rules.

Disclaimer: This blog is meant for informational purposes only and should not be considered as tax advice. Consult with a qualified tax professional or advisor for personalized guidance based on your specific situation.

Reach out to us today at [email protected], and let's work together to optimize your tax situation and financial well-being. Your journey towards a more tax-efficient future starts here.