5 Red Flags That Signal It’s Time to Outsource Your Bookkeeping

As your business grows, so do your financial responsibilities. While managing your own bookkeeping might have worked when you first started, there may come a point where it becomes overwhelming. Outsourcing your bookkeeping can save time, reduce errors, and ensure your business stays financially compliant. Here are five red flags that signal it might be time to consider outsourcing your bookkeeping.

1. Frequent Errors in Financial Records

One of the biggest indicators that it’s time to outsource your bookkeeping is frequent errors in your financial records. Mistakes in invoicing, expense tracking, and financial statements can cost your business money, cause cash flow problems, and lead to serious tax issues down the road.

Solution: Hiring a professional bookkeeper reduces the risk of errors. They have the knowledge and tools to ensure that your financial records are accurate and up to date, giving you peace of mind.

2. Missed Deadlines and Late Payments

If you’re consistently missing payment deadlines, filing taxes late, or struggling to meet other financial obligations, it could be a sign that you’re spread too thin. This can damage your relationships with suppliers and customers and lead to penalties from tax authorities.

Solution: Outsourcing to a bookkeeping service ensures that all your financial obligations are met on time. They can manage your payroll, invoicing, and taxes, ensuring deadlines are never missed.

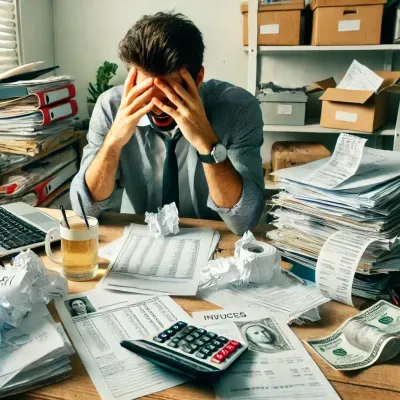

3. Disorganized Financial Records

Do you struggle to find important financial documents when you need them? A disorganized financial system can make it difficult to track expenses, understand your cash flow, or prepare for tax season.

Solution: A professional bookkeeping service will implement an organized system for your financial records, making it easy to find and track your business’s financial information.

4. Spending Too Much Time on Bookkeeping

As a business owner, your time is better spent on growing your business and serving your clients rather than dealing with the day-to-day bookkeeping tasks. If you find that bookkeeping is taking up a large portion of your time, it might be time to outsource.

Solution: By outsourcing your bookkeeping, you free up time to focus on your core business activities, allowing you to grow and scale your business.

5. Lack of Financial Expertise

Bookkeeping involves more than just tracking expenses and income. It requires a deep understanding of financial regulations, tax laws, and compliance issues. If you’re unsure whether you’re following all the necessary regulations, it’s time to bring in an expert.

Solution: A professional bookkeeper has the expertise to ensure your business remains compliant with financial regulations, helping you avoid penalties and costly mistakes.

Conclusion

Outsourcing your bookkeeping is a smart decision when you recognize any of these red flags. It ensures compliance, accuracy, and efficiency, allowing you to focus on what you do best—running your business. Don’t wait until financial errors or missed deadlines cause problems. Take action today and consider the benefits of professional bookkeeping services.

Disclaimer: This blog is for informational purposes only and should not be considered tax advice. Consult with a qualified tax professional or advisor for personalized guidance based on your specific situation.

Reach out to us today at [email protected], and let's work together to optimize your tax situation and financial well-being. Your journey towards a more tax-efficient future starts here.